Understanding The Federal Funds Rate And Its Economic Impact

The term "Federal Funds Rate" plays a pivotal role in the economic landscape of today's world. Often referred to as the Fed rate, it is the interest rate at which depository institutions lend reserve balances to other banks on an overnight basis. Established by the Federal Reserve, this benchmark significantly influences borrowing costs, inflation rates, and the overall stability of the economy. Gaining insight into the Fed rate is crucial for anyone aiming to make well-informed financial decisions. Whether you're a business owner, an investor, or a regular consumer, the Fed rate has profound implications on your everyday life that you might not fully recognize.

The Federal Reserve, frequently abbreviated as "the Fed," holds a central role in steering the U.S. economy. By modifying the Fed rate, the central bank can either stimulate growth during economic recessions or slow down an overheated economy. This strategic tool ensures that inflation remains controlled while fostering sustainable economic expansion. Consequently, staying informed about the Fed rate can empower you to foresee changes in interest rates, mortgage costs, and other financial factors that directly affect your life.

In this comprehensive guide, we will explore the intricacies of the Fed rate. We will delve into its definition, how it operates, and its broader implications for the economy. Whether you're passionate about finance or simply curious about how monetary policy impacts your finances, this article will equip you with the knowledge necessary to stay ahead in an ever-changing financial world.

Read also:Understanding Ripple A Comprehensive Guide To Its Technology And Impact

Table of Contents

- What is the Federal Funds Rate?

- How Does the Federal Funds Rate Function?

- The Crucial Role of the Federal Funds Rate

- Factors Influencing the Federal Funds Rate

- The Federal Funds Rate's Influence on the Economy

- A Historical Analysis of Federal Funds Rate Adjustments

- Investment Opportunities and Challenges with the Federal Funds Rate

- How the Federal Funds Rate Impacts Consumers

- Predicting Future Trends in Federal Funds Rate Adjustments

- Conclusion

What is the Federal Funds Rate?

The Federal Funds Rate, commonly known as the Fed rate, refers to the interest rate at which banks lend reserve balances to one another overnight. Established by the Federal Open Market Committee (FOMC), this rate serves as a cornerstone for various financial products, including mortgages, credit cards, and loans. It is one of the primary instruments the Federal Reserve employs to execute monetary policy and influence economic conditions.

Understanding the Fundamentals of the Federal Funds Rate

At its core, the Federal Funds Rate dictates the cost for financial institutions to borrow money from each other. When the Fed lowers the rate, borrowing becomes more affordable, encouraging spending and investment. Conversely, raising the rate makes borrowing more expensive, potentially slowing economic activity and controlling inflation. For instance, during times of economic uncertainty, the Fed might lower the rate to stimulate growth, leading to reduced mortgage rates and making homeownership more accessible. During periods of high inflation, the Fed may increase the rate to discourage excessive spending and stabilize prices.

How Does the Federal Funds Rate Function?

The process of setting the Federal Funds Rate involves meticulous analysis of economic indicators by the FOMC. The committee convenes eight times annually to assess the current economic climate and decide whether to adjust the rate. By targeting a specific range for the Federal Funds Rate, the Fed influences short-term interest rates throughout the financial system.

Key Mechanisms Driving the Federal Funds Rate

- Open Market Operations: The Fed buys or sells government securities to influence the supply of money within the banking system.

- Reserve Requirements: Banks are mandated to maintain a certain percentage of deposits as reserves. Adjusting these requirements can impact the Federal Funds Rate.

- Discount Rate: The interest rate charged to commercial banks and other depository institutions on loans they receive from the Fed's discount window.

These mechanisms work in tandem to ensure that the Federal Funds Rate aligns with the central bank's objectives for economic growth, employment, and price stability.

The Crucial Role of the Federal Funds Rate

The Federal Funds Rate plays an indispensable role in shaping the economic environment. It influences everything from consumer spending to business investment, impacting the overall health of the economy. By modifying the rate, the Fed can address economic challenges and promote stability.

Why the Federal Funds Rate is Significant

For businesses, the Federal Funds Rate determines the cost of borrowing capital for expansion or operations. Lower rates can spur increased investment, while higher rates might deter spending. Similarly, consumers benefit from reduced interest payments on loans and credit cards when rates are lower. Understanding the Federal Funds Rate empowers individuals and organizations to make more informed financial decisions.

Read also:Understanding The Federal Funds Rate And Its Economic Impact

Factors Influencing the Federal Funds Rate

Multiple factors influence the Fed's decision to adjust the Federal Funds Rate. These include inflation levels, unemployment rates, and global economic conditions. The FOMC meticulously monitors these indicators to determine the appropriate course of action.

Primary Factors to Consider

- Inflation: The Fed aims to maintain inflation around 2%, adjusting the rate to achieve this target.

- Employment: High unemployment rates may prompt the Fed to lower the rate to stimulate job creation.

- Global Events: Economic conditions in other countries can influence U.S. monetary policy decisions.

Data from reliable sources such as the Bureau of Labor Statistics and the International Monetary Fund often inform the FOMC's decisions.

The Federal Funds Rate's Influence on the Economy

The Federal Funds Rate has extensive effects on the economy, impacting everything from consumer behavior to corporate strategy. When the rate changes, it triggers a chain reaction that can either accelerate or decelerate economic activity.

Impacts on Various Sectors

In the housing market, for instance, fluctuations in the Federal Funds Rate directly affect mortgage rates. Lower rates can spur a surge in home purchases, while higher rates might discourage buyers. Similarly, businesses may postpone expansion plans if borrowing costs rise, affecting job creation and economic growth.

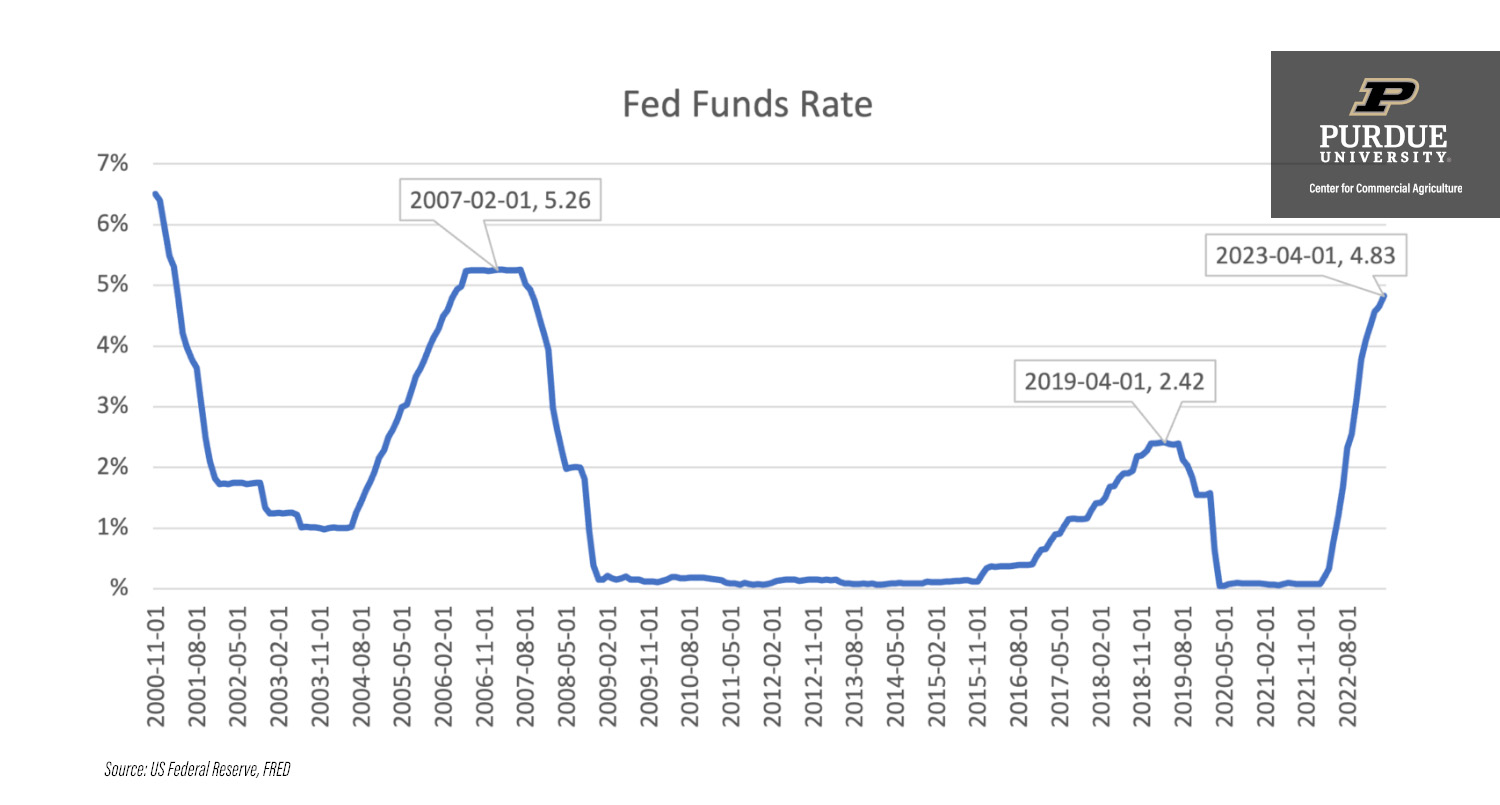

A Historical Analysis of Federal Funds Rate Adjustments

Examining historical trends can provide valuable insights into the Fed's approach to monetary policy. During the 2008 financial crisis, for example, the Fed reduced the rate to near zero to stimulate the economy. Conversely, during the late 1970s and early 1980s, the Fed significantly increased rates to combat rampant inflation.

Lessons from History

These historical examples underscore the Fed's role in navigating economic challenges. By studying past decisions, we can better comprehend the rationale behind current policy adjustments and their potential outcomes.

Investment Opportunities and Challenges with the Federal Funds Rate

Investors closely monitor Federal Funds Rate decisions, as they can profoundly impact asset prices and market performance. Changes in the rate often lead to shifts in stock, bond, and commodity markets, affecting portfolios across the board.

Strategies for Investors

- Stock Market: Lower rates can boost stock prices by making borrowing cheaper for companies.

- Bond Market: Rising rates typically lead to lower bond prices, as existing bonds become less attractive compared to newly issued ones with higher yields.

- Commodities: The relationship between the Federal Funds Rate and commodity prices is complex, influenced by factors such as inflation and currency strength.

By comprehending these dynamics, investors can position their portfolios to capitalize on potential opportunities.

How the Federal Funds Rate Impacts Consumers

Consumers experience the effects of Federal Funds Rate changes in numerous ways, from credit card interest rates to auto loans. These adjustments can influence household budgets and financial planning, making it essential for individuals to stay informed.

Everyday Impacts

For example, a higher Federal Funds Rate might result in increased credit card interest charges, making it more costly to carry a balance. Similarly, adjustable-rate mortgages could see higher payments if the Fed raises rates. On the other hand, savers might benefit from higher returns on savings accounts and certificates of deposit.

Predicting Future Trends in Federal Funds Rate Adjustments

Looking ahead, the Fed will continue to monitor economic conditions and adjust the Federal Funds Rate accordingly. With ongoing challenges such as inflation and global uncertainties, the central bank's decisions will significantly shape the future economic landscape.

Anticipating Future Moves

Experts anticipate that the Fed will adopt a cautious approach, balancing the need for growth with the risk of inflation. By staying informed about economic indicators and Fed announcements, individuals and businesses can prepare for potential changes and their implications.

Conclusion

The Federal Funds Rate is a powerful instrument in the Federal Reserve's toolkit, influencing economic conditions and financial decisions at all levels. From controlling inflation to fostering job creation, its impact is felt across industries and households. By understanding the mechanisms behind the Federal Funds Rate and its effects, you can make more informed financial choices and navigate the ever-evolving economic environment.

We encourage you to share your thoughts and experiences in the comments below. How has the Federal Funds Rate influenced your personal finances or business decisions? Additionally, explore other articles on our site to expand your knowledge of financial topics and stay ahead in today's dynamic world.