Understanding Today's Interest Rates: A Comprehensive Guide

In the modern economic landscape, interest rates are a cornerstone in shaping financial decisions for both individuals and businesses. Whether you're considering borrowing, investing, or saving, staying informed about current interest rates is essential. The constant fluctuations in these rates can have profound implications for your financial strategy and overall economic stability. This article delves deep into the world of interest rates, offering actionable insights and expert analysis to help you make well-informed decisions.

In an era marked by economic uncertainty, keeping abreast of interest rates is more critical than ever. Central banks worldwide continually adjust these rates to manage inflation, stimulate growth, and stabilize economies. By gaining a deeper understanding of the factors influencing interest rates, you can better anticipate market shifts and safeguard your financial interests.

This extensive guide will explore everything you need to know about interest rates, including their definitions, determination methods, effects on various sectors, and strategies to mitigate risks. Whether you're an experienced investor or a first-time borrower, this article aims to equip you with the tools and knowledge to navigate the complexities of modern finance effectively.

Read also:Discover The Hidden Gem Of Columbus Indiana

Table of Contents

- What Are Interest Rates?

- Current Interest Rates Today

- Factors Affecting Interest Rates

- Impact on the Economy

- Impact on Personal Finance

- Historical Perspective of Interest Rates

- The Role of Central Banks in Setting Interest Rates

- Investment Strategies Amid Changing Interest Rates

- Future Outlook of Interest Rates

- Conclusion

What Are Interest Rates?

Interest rates represent the percentage charged or paid on loans, savings, and investments, serving as a fundamental element of the financial system. For borrowers, they signify the cost of borrowing money, while for savers, they reflect the return on deposits. Understanding interest rates is crucial for making sound financial decisions, as they directly influence both personal and corporate finance.

Types of Interest Rates

- Nominal Interest Rate: The stated interest rate before accounting for inflation.

- Real Interest Rate: The nominal rate adjusted for inflation, offering a clearer picture of the actual cost or return.

- Fixed vs. Variable Rates: Fixed rates remain unchanged throughout the loan term, providing stability, while variable rates fluctuate based on market conditions, offering potential savings but with the risk of future increases.

Distinguishing between these types of interest rates is essential for tailoring financial strategies. For example, fixed rates provide predictable payments, whereas variable rates may start lower but carry the risk of rising over time.

Current Interest Rates

As of the latest reports, interest rates vary widely across different financial products and regions. Central banks, such as the Federal Reserve, European Central Bank, and others, continuously monitor and adjust these rates to maintain economic stability.

Key Statistics on Interest Rates

- Federal Funds Rate: Currently at [X%] as of [Date].

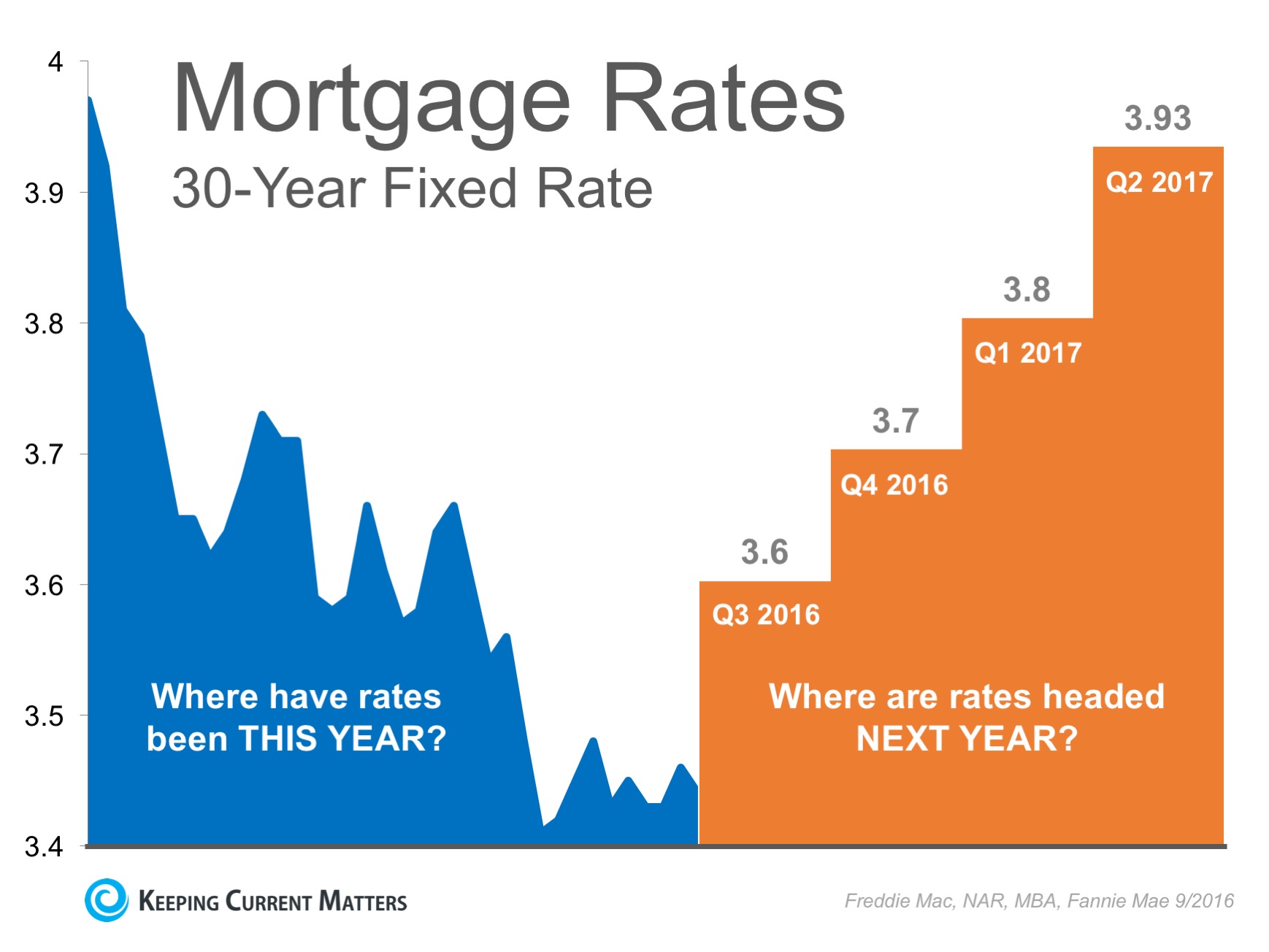

- Mortgage Rates: Average 30-year fixed-rate mortgages stand at [Y%].

- Savings Account Rates: Many banks offer rates ranging between [Z%] and [A%].

These figures provide a snapshot of the current financial environment. However, it's crucial to recognize that interest rates can change swiftly in response to economic indicators and global developments.

Factors Affecting Interest Rates

Interest rates are influenced by a variety of factors, including inflation, economic growth, and geopolitical events. Central banks analyze these factors to set interest rates that maintain economic balance. Understanding these influences can help individuals and businesses better anticipate rate changes and adjust their financial strategies accordingly.

Inflation and Its Role

Inflation significantly impacts interest rates. When inflation rises, central banks often increase interest rates to control spending and stabilize prices. Conversely, during periods of low inflation or deflation, interest rates may be lowered to encourage borrowing and investment, thereby stimulating economic activity.

Read also:Cassper Nyovest Drama Nota Baloyi Weighs In Fans React

Impact on the Economy

Interest rates have wide-ranging effects on the economy, influencing consumer spending, business investments, and government fiscal policies. Lower interest rates can spur economic growth by making borrowing more affordable, while higher rates can help control inflation by reducing spending.

Effects on Key Sectors

- Housing Market: Lower interest rates can stimulate home purchases, while higher rates may discourage buying activity.

- Stock Market: Changes in interest rates often lead to fluctuations in stock prices as companies adjust their borrowing costs, impacting investor sentiment.

- Government Debt: Interest rates affect the cost of servicing national debt, influencing budget allocations and fiscal policy decisions.

Impact on Personal Finance

For individuals, interest rates play a vital role in managing personal finances. Whether you're planning to buy a home, save for retirement, or invest in the stock market, understanding how interest rates affect your financial decisions is crucial. By aligning your strategies with prevailing rates, you can optimize returns and minimize risks.

Strategies for Borrowers and Savers

- Borrowers: Consider locking in fixed-rate loans when interest rates are low to protect against future increases.

- Savers: Explore high-yield savings accounts or certificates of deposit when interest rates are on the rise to maximize returns.

Implementing these strategies can help you navigate the complexities of personal finance in a dynamic interest rate environment.

Historical Perspective of Interest Rates

Examining historical trends provides valuable insights into the evolution of interest rates. For example, during the 1980s, interest rates reached record highs due to high inflation. In contrast, the post-2008 financial crisis saw interest rates drop to near-zero levels to stimulate economic recovery.

Lessons from the Past

History demonstrates that interest rates are cyclical, influenced by broader economic cycles. By studying past patterns, we can better anticipate future movements and prepare for potential changes in the financial landscape.

The Role of Central Banks in Setting Interest Rates

Central banks, such as the Federal Reserve and European Central Bank, play a crucial role in setting interest rates. They employ monetary policy tools to influence the economy, aiming to achieve price stability, full employment, and sustainable growth. These institutions carefully balance their policies to ensure economic stability and resilience.

Monetary Policy Tools

- Open Market Operations: Central banks buy or sell government securities to control the money supply and influence interest rates.

- Reserve Requirements: Central banks set the minimum amount of funds banks must hold in reserve, affecting liquidity and borrowing costs.

- Discount Rate: The interest rate charged to commercial banks for borrowing from the central bank, influencing broader lending rates.

These tools enable central banks to fine-tune interest rates and manage economic conditions effectively, ensuring stability and growth.

Investment Strategies Amid Changing Interest Rates

Investors must adapt their strategies to changing interest rates. While some asset classes benefit from rising rates, others may face challenges. Diversification and flexibility are key to navigating this dynamic environment successfully.

Asset Allocation Tips

- Bonds: Consider shorter-term bonds during periods of rising interest rates to minimize price volatility and potential losses.

- Equities: Focus on sectors that historically perform well during periods of rising interest rates, such as financials and industrials, for enhanced returns.

By tailoring your investment approach to current interest rates, you can optimize your portfolio's performance and achieve your financial goals.

Future Outlook of Interest Rates

The future trajectory of interest rates remains uncertain, shaped by economic forecasts and global developments. Analysts predict potential increases as central banks aim to rein in inflation. However, geopolitical tensions and unforeseen events could alter this outlook significantly.

What to Expect

- Gradual increases in interest rates to manage inflation pressures effectively.

- Regional variations as different central banks pursue distinct monetary policies tailored to their specific economic conditions.

Staying informed and agile will help you navigate the evolving landscape of interest rates and make well-informed financial decisions.

Conclusion

Interest rates are a critical component of the global financial system, influencing everything from consumer behavior to macroeconomic policies. By understanding the factors driving interest rates and their implications, you can make smarter financial decisions and protect your assets. This knowledge empowers you to navigate the complexities of modern finance confidently.

We invite you to share your thoughts and experiences in the comments below. Your feedback helps us improve and provide even more valuable content. Additionally, explore our other articles for further insights into personal finance, investing, and economic trends. Together, let's secure a brighter financial future.