Understanding Interest Rates: A Comprehensive Guide

Interest rates are a cornerstone of the global economy, shaping financial decisions for individuals and businesses alike. Whether you're saving, borrowing, or investing, understanding the intricacies of interest rates is essential. These rates impact a wide range of financial activities, from mortgage payments and credit card debt to business loans and investment opportunities. This article provides an in-depth exploration of interest rates, their various types, and their effects on personal and corporate finance.

Interest rates are among the most significant topics in economics, transcending mere numbers on financial statements. They serve as powerful tools for central banks to regulate inflation, stimulate or slow economic growth, and manage monetary policy. By the end of this article, you will gain a comprehensive understanding of how interest rates influence your financial well-being and how you can leverage them to make well-informed decisions.

This guide is meticulously crafted to provide actionable insights and expert advice, helping you navigate the complexities of interest rates. From foundational knowledge to advanced strategies, we will cover everything necessary to build a solid understanding of this critical area of finance.

Read also:Nota Baloyis Court Drama An Emotional Day In The Spotlight

Table of Contents

- What Are Interest Rates?

- Types of Interest Rates

- Factors Affecting Interest Rates

- The Role of Central Banks in Setting Interest Rates

- How Interest Rates Impact the Economy

- Interest Rates and Personal Finance

- Impact of Interest Rates on Businesses

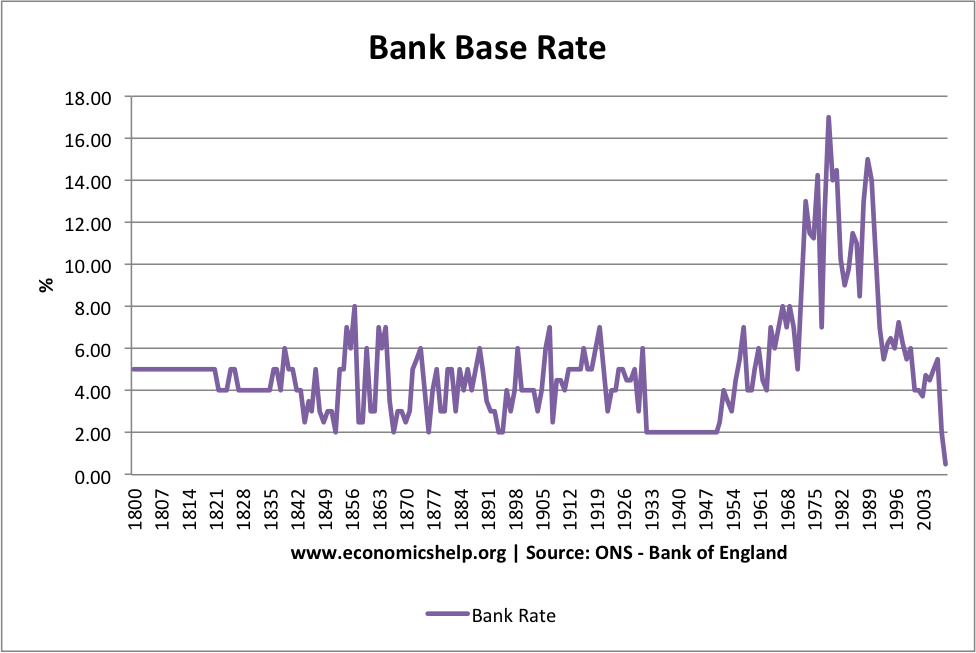

- Historical Trends in Interest Rates

- Future Predictions for Interest Rates

- Conclusion

Understanding the Concept of Interest Rates

Interest rates represent the cost of borrowing money or the reward for saving it. They are expressed as a percentage of the principal amount borrowed or deposited. This foundational concept is integral to the functioning of modern economies. For example, when you secure a mortgage, the interest rate determines the additional amount you will pay over the loan's lifespan.

Interest rates can either be fixed or variable, depending on the agreement between the lender and borrower. Fixed rates remain constant throughout the loan term, offering predictability. Variable rates, on the other hand, fluctuate based on market conditions, providing flexibility. Grasping the distinction between these types is vital for making prudent financial decisions.

How Are Interest Rates Calculated?

The computation of interest rates involves multiple factors, including the principal amount, loan duration, and prevailing market conditions. Lenders evaluate risk and creditworthiness before determining the appropriate rate. For instance, individuals with higher credit scores are often eligible for lower interest rates due to their reduced likelihood of defaulting.

Banks and financial institutions employ sophisticated formulas to calculate interest rates, ensuring alignment with regulatory standards and market trends. This process promotes fairness and transparency in the lending process, fostering trust between lenders and borrowers.

Exploring the Different Types of Interest Rates

Interest rates come in various forms, each serving a distinct purpose. Below is a detailed look at the most common types:

- Nominal Interest Rate: The stated rate that does not account for inflation.

- Real Interest Rate: Adjusted for inflation, this rate provides a more accurate reflection of purchasing power.

- Discount Rate: The rate charged by central banks to commercial banks for short-term loans.

- Prime Rate: The lowest rate offered to the most creditworthy customers by banks.

Comprehending the differences between these rates is crucial for both consumers and businesses. Each type plays a unique role in shaping financial strategies and decision-making processes, impacting everything from personal savings to corporate investments.

Read also:Discover The Transformative Experience At Mount St Marys University

Key Factors Influencing Interest Rates

Several pivotal factors influence the movement of interest rates:

- Inflation: Higher inflation typically results in higher interest rates as lenders aim to preserve the value of their returns.

- Economic Growth: Strong economic growth can lead to increased demand for loans, driving up interest rates.

- Central Bank Policies: Decisions made by central banks, such as adjusting benchmark rates, directly impact interest rates.

- Global Events: Political instability, natural disasters, and other global events can create uncertainty, affecting interest rates.

By closely monitoring these factors, individuals and businesses can better anticipate changes in interest rates and adjust their financial strategies accordingly, ensuring preparedness for any economic shifts.

The Central Role of Central Banks in Setting Interest Rates

Central banks, such as the Federal Reserve in the United States and the European Central Bank, wield significant influence in setting interest rates. They employ monetary policy tools to influence economic conditions and maintain stability. For example, during periods of high inflation, central banks may raise interest rates to cool down the economy and restore balance.

How Central Banks Shape the Economy

Central banks adjust interest rates to achieve specific economic objectives, such as controlling inflation, boosting employment, and stabilizing currency values. By lowering rates, they encourage borrowing and spending, stimulating economic growth. Conversely, raising rates can help curb excessive spending and mitigate inflationary pressures.

These actions have far-reaching implications for consumers, businesses, and global markets. Understanding the role of central banks is indispensable for anyone navigating the complexities of modern finance, enabling better financial planning and decision-making.

The Profound Impact of Interest Rates on the Economy

Interest rates exert a profound influence on the broader economy, impacting consumer spending, business investment, and government fiscal policies. For instance, lower interest rates can spur increased borrowing for home purchases and business expansion, boosting economic activity and fostering growth.

On the other hand, higher interest rates can slow down economic growth by making borrowing more expensive. This can lead to reduced consumer spending and decreased business investment, creating challenges for economic stability. Balancing these effects is a crucial challenge for policymakers and central banks, requiring careful consideration and strategic planning.

Interest Rates and Their Impact on Personal Finance

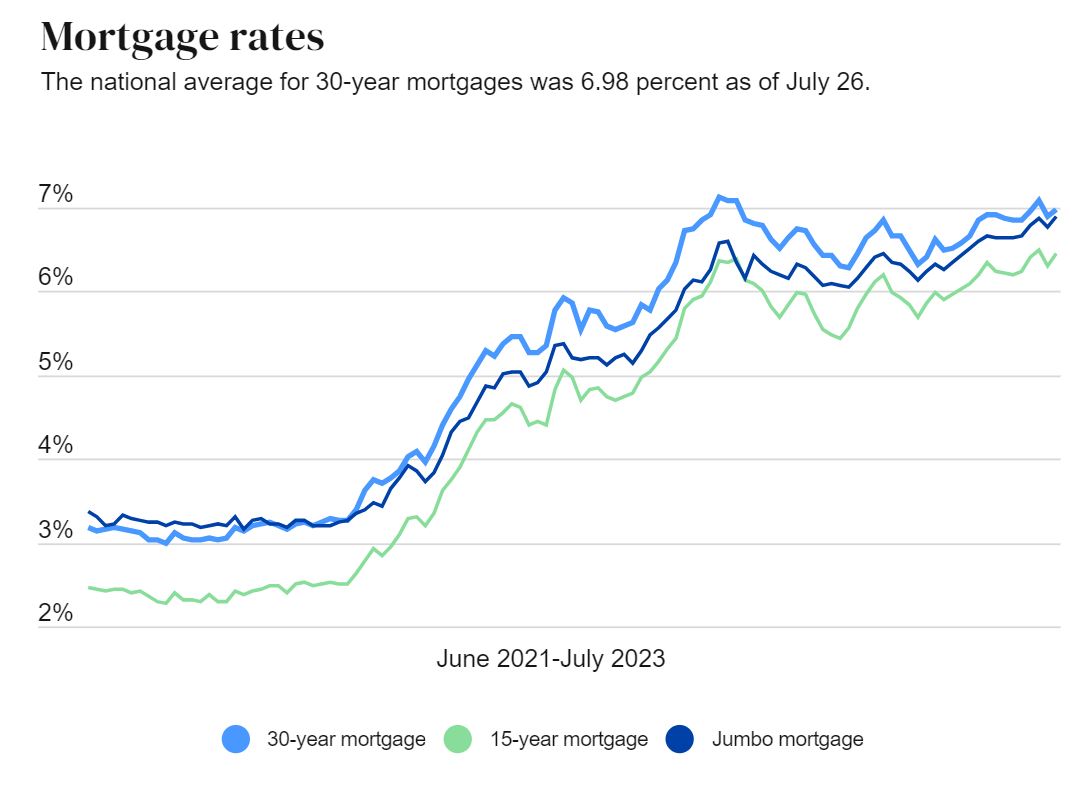

Interest rates significantly affect personal finance decisions, including saving, borrowing, and investing. For example, when interest rates are low, it may present an ideal opportunity to secure a mortgage or refinance existing debt. Conversely, higher rates can make saving more appealing, as returns on savings accounts and certificates of deposit increase.

Tips for Managing Personal Finances Amid Interest Rate Changes

To effectively manage personal finances during periods of interest rate fluctuations, consider the following strategies:

- Monitor economic indicators to anticipate rate changes and prepare accordingly.

- Lock in favorable rates on long-term loans when rates are low to secure savings over time.

- Explore investment opportunities that benefit from rising rates, such as bonds, to maximize returns.

By staying informed and proactive, individuals can optimize their financial outcomes in response to changing interest rates, ensuring long-term financial security and growth.

The Impact of Interest Rates on Businesses

Interest rates have a substantial impact on businesses, influencing everything from borrowing costs to operational expenses. For example, higher interest rates can increase the cost of financing capital expenditures, such as purchasing new equipment or expanding facilities, potentially straining cash flow and reducing profitability.

Conversely, lower interest rates can create opportunities for businesses to expand and invest in growth initiatives. Companies may also benefit from reduced borrowing costs, enabling them to allocate resources more efficiently and enhance overall performance.

Strategies for Businesses to Manage Interest Rate Risks

Businesses can implement several strategies to mitigate interest rate risks:

- Utilize fixed-rate loans to lock in favorable rates and ensure stability in financing costs.

- Hedge against interest rate fluctuations using financial derivatives, providing protection against unexpected changes.

- Optimize cash flow management to maintain liquidity during periods of rate volatility, ensuring operational resilience.

These proactive measures can help businesses maintain financial stability and capitalize on opportunities presented by changing interest rates, fostering long-term success and growth.

Analyzing Historical Trends in Interest Rates

Examining historical trends in interest rates offers valuable insights into their behavior and potential future movements. For example, during the 1980s, interest rates in the United States reached historic highs as the Federal Reserve worked diligently to combat rampant inflation. Conversely, the 2008 financial crisis led to record-low rates as central banks sought to stimulate economic recovery and restore stability.

By studying these trends, analysts and policymakers can better predict future rate movements and develop strategies to address potential challenges, ensuring preparedness for any economic shifts.

Predicting Future Movements in Interest Rates

Forecasting future interest rate movements involves analyzing a wide range of economic indicators and global trends. While predicting exact rates remains challenging, experts generally agree that rates will remain relatively low in the near term due to ongoing economic recovery efforts. However, as inflationary pressures increase, central banks may gradually raise rates to maintain stability and prevent overheating of the economy.

Staying informed about global economic developments and central bank policies is essential for anyone seeking to anticipate future interest rate changes and prepare accordingly, ensuring readiness for any economic shifts.

Conclusion

In summary, interest rates are a critical component of modern finance, influencing everything from personal savings to global economic policies. Understanding their mechanics, types, and effects is essential for making informed financial decisions. By staying informed about economic trends and central bank policies, individuals and businesses can effectively navigate the complexities of interest rates and achieve their financial goals.

We invite you to share your thoughts and experiences with interest rates in the comments section below. Additionally, feel free to explore other articles on our site for more insights into personal finance, economics, and investment strategies. Together, let's build a stronger financial future and empower ourselves with knowledge!

![Buying a Home? Mortgage Rate Guide for Singapore [2023]](https://blog.roshi.sg/wp-content/uploads/2022/08/Singapore-Home-Loan-Rates-2022.jpeg)