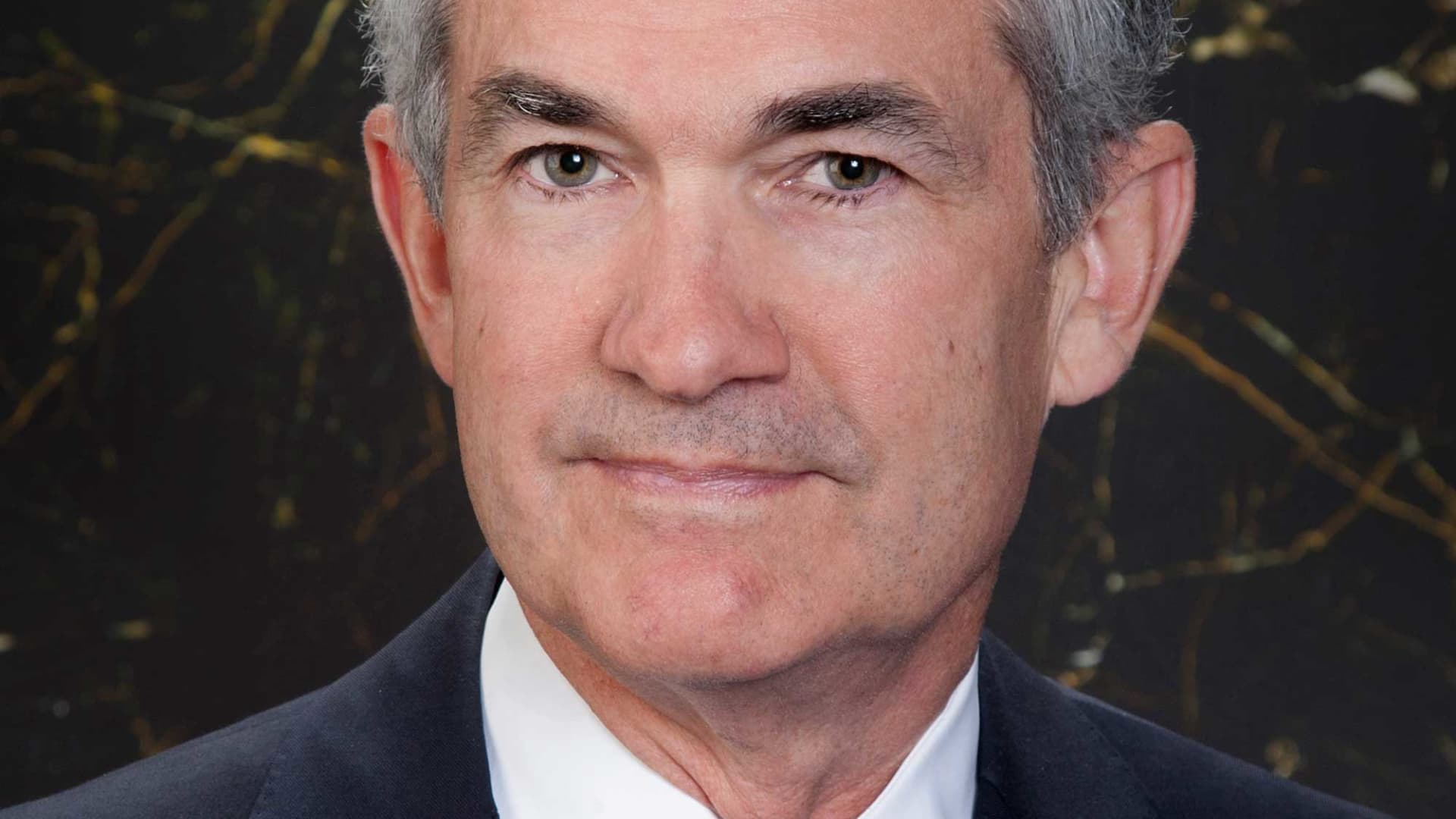

Jerome Powell: A Pivotal Figure In Global Economic Policy

Jerome Powell, the current Chair of the Federal Reserve, stands as one of the most influential individuals in shaping the trajectory of global economic policy. Through his adept leadership during unprecedented economic challenges, he has emerged as a key player in navigating the complexities of modern finance. As you delve into this article, you will uncover how his policies have not only redefined central banking but also significantly impacted economies worldwide.

Since becoming the Chair of the Federal Reserve in 2018, Jerome Powell has played an indispensable role in steering the U.S. economy through periods of immense turbulence. His tenure has been defined by major events, such as the 2020 pandemic-induced recession and the subsequent recovery efforts. A deeper understanding of his background, policies, and leadership style offers valuable insights into the future direction of monetary policy and its global implications.

For economists, investors, or anyone interested in the forces that shape global economies, Jerome Powell's contributions merit exploration. This article will examine his career, analyze his policy decisions, and evaluate their effects on both the U.S. and global economies, providing a comprehensive overview of his impact.

Read also:Donovan Mitchell The Nba Star Shaping The Future Of Basketball

Table of Contents

- Biography

- Early Life and Education

- Career Path

- Role at the Federal Reserve

- Key Policies Under Jerome Powell

- Economic Impact of His Leadership

- Challenges Faced by Jerome Powell

- Global Influence of His Policies

- Criticisms and Controversies

- Future Direction of Monetary Policy

- Conclusion

An In-Depth Look at Jerome Powell's Background

Jerome Powell, a towering figure in the realm of global finance, boasts a career marked by remarkable achievements. The following section provides a detailed examination of his personal and professional journey, highlighting the factors that have shaped his leadership style and contributions to the field of economics.

Early Life and Educational Foundation

Born on February 4, 1953, in Washington, D.C., Jerome Powell grew up in a middle-class family that placed a strong emphasis on education and hard work. His formative years were spent at the prestigious Georgetown Preparatory School, where he cultivated a profound interest in economics and public policy. This early exposure laid the groundwork for his future endeavors in both fields.

Powell's academic pursuits continued at Princeton University, where he graduated with a Bachelor of Arts in Politics in 1975. He further enriched his educational foundation by earning a Juris Doctor from Georgetown University Law Center in 1979. These academic accomplishments equipped him with a robust understanding of law and governance, which would later prove invaluable in his career in finance and public service.

Professional Evolution

Powell's professional journey began in the private sector, where he initially worked as a corporate lawyer before transitioning into investment banking. His experiences in the financial world provided him with a deep understanding of global market dynamics. In 1990, he embarked on a career in public service as an Under Secretary for Domestic Finance at the U.S. Treasury Department under President George H.W. Bush.

| Full Name | Jerome H. Powell |

|---|---|

| Date of Birth | February 4, 1953 |

| Place of Birth | Washington, D.C. |

| Education | Princeton University (B.A. in Politics), Georgetown University Law Center (J.D.) |

| Profession | Economist, Lawyer, Central Banker |

Charting Jerome Powell's Career Path

Powell's career trajectory exemplifies his commitment and expertise in the realms of economics and finance. Following his tenure at the Treasury Department, he joined The Carlyle Group, one of the world's largest private equity firms, where he served as a managing director. This period was instrumental in honing his financial management and strategic decision-making skills.

In 2012, Powell was appointed as a member of the Board of Governors of the Federal Reserve System by President Barack Obama, marking the beginning of his influential role in shaping U.S. monetary policy. His appointment as the Chair of the Federal Reserve in 2018, nominated by President Donald Trump, solidified his position as a key player in global finance.

Read also:Washington State Department Of Transportation Enhancing Mobility And Connectivity

Jerome Powell's Role at the Federal Reserve

In his capacity as the Chair of the Federal Reserve, Jerome Powell leads one of the most influential institutions globally. His responsibilities encompass setting monetary policy, ensuring financial stability, and promoting maximum employment and stable prices. Under his stewardship, the Federal Reserve has implemented innovative policies to address complex economic challenges.

Monetary Policy Framework

Powell advocates for a flexible approach to monetary policy, recognizing the necessity of adapting to evolving economic conditions. One of his notable contributions is the introduction of "average inflation targeting," which allows inflation to moderately exceed 2% for a period to compensate for times when it falls below the target, thereby fostering economic balance.

Financial Stability Initiatives

Ensuring financial stability remains a cornerstone of Powell's leadership. He has been instrumental in strengthening regulatory frameworks and enhancing the resilience of financial institutions. His efforts have been pivotal in mitigating systemic risks and bolstering confidence in the financial system, reinforcing the Federal Reserve's role as a stabilizing force in the global economy.

Notable Policies Under Jerome Powell's Leadership

Throughout his tenure, Jerome Powell has implemented several groundbreaking policies that have significantly influenced both the U.S. and global economies. Below are some of the most impactful policies:

- Quantitative Easing (QE): In response to the pandemic, the Federal Reserve initiated a massive QE program to inject liquidity into the economy, stabilizing financial markets and supporting recovery efforts.

- Interest Rate Adjustments: Powell has skillfully navigated interest rate adjustments, striking a balance between fostering economic growth and managing inflation.

- Forward Guidance: By utilizing forward guidance, he has enhanced transparency and predictability in the Federal Reserve's policy intentions, aiding market participants in making informed decisions.

The Economic Impact of Jerome Powell's Leadership

Under Jerome Powell's guidance, the U.S. economy has experienced substantial growth and recovery following the pandemic-induced recession. His policies have contributed to historically low unemployment rates, underscoring the efficacy of his monetary strategies in stimulating economic activity.

Job Creation and Economic Growth

During Powell's tenure, the U.S. has witnessed a remarkable surge in job creation, with millions of new jobs added to the economy. This achievement highlights the positive impact of his monetary policies in driving economic expansion and improving livelihoods.

Inflation Management and Price Stability

Managing inflation has been a central focus of Powell's leadership. Through innovative strategies such as average inflation targeting, he has ensured that inflation remains within acceptable limits, preserving the purchasing power of consumers and fostering a stable economic environment conducive to growth.

Navigating Challenges: Jerome Powell's Leadership in Turbulent Times

Despite his successes, Jerome Powell has encountered numerous challenges during his tenure. The global pandemic introduced unprecedented economic disruptions, necessitating swift and decisive action. Additionally, geopolitical tensions and supply chain disruptions have added layers of complexity to his role as Federal Reserve Chair.

Pandemic Response and Economic Stabilization

Powell's response to the pandemic has garnered widespread acclaim. He implemented emergency measures, including reducing interest rates to near zero and launching extensive asset purchase programs. These actions were instrumental in stabilizing financial markets and facilitating economic recovery.

Addressing Supply Chain Disruptions

Supply chain disruptions have posed significant challenges to economic stability. Powell has collaborated closely with policymakers and industry leaders to address these issues, ensuring that they do not impede the recovery process and maintaining the momentum of economic growth.

The Global Influence of Jerome Powell's Policies

Jerome Powell's policies have had far-reaching effects on global economies. As the Chair of the Federal Reserve, his decisions influence currency values, trade balances, and investment flows worldwide. Central banks globally often look to the Federal Reserve for guidance, amplifying Powell's influence on the international stage.

International Cooperation and Global Challenges

Powell underscores the importance of international cooperation in addressing global economic challenges. He actively participates in international forums, advocating for coordinated efforts to tackle pressing issues such as climate change and financial stability, reinforcing the interconnectedness of global economies.

Impact on Emerging Markets

His policies have also had a profound impact on emerging markets. By maintaining stable interest rates and promoting economic growth in the U.S., Powell has fostered a favorable environment for emerging economies to thrive, contributing to global economic balance and stability.

Criticisms and Controversies Surrounding Jerome Powell's Leadership

While Jerome Powell's accomplishments are undeniable, his leadership has not been without criticism. Some argue that his accommodative monetary policies have contributed to asset price inflation, disproportionately benefiting the wealthy and exacerbating wealth inequality. Others express concerns about the long-term sustainability of his policies in the context of rising national debt.

Wealth Inequality and Economic Disparities

A prevalent criticism of Powell's policies is their potential to widen the wealth gap. By driving up asset prices, his strategies have disproportionately favored those who hold significant financial assets, raising concerns about the equitable distribution of economic benefits.

National Debt and Long-Term Sustainability

Another area of concern is the sustainability of the U.S. national debt. Critics argue that the Federal Reserve's accommodative policies may lead to higher debt levels, posing potential risks to future economic stability and necessitating careful consideration of long-term fiscal strategies.

The Future Direction of Monetary Policy Under Jerome Powell

As the global economy continues to evolve, Jerome Powell's leadership will remain pivotal in shaping the future of monetary policy. The Federal Reserve must adapt its strategies to address emerging challenges such as climate change, technological advancements, and demographic shifts, ensuring the continued effectiveness of its policies in fulfilling its mandate.

Integrating Climate Risks into Financial Stability Assessments

Climate change is increasingly becoming a critical consideration for central banks. Powell has acknowledged the importance of integrating climate risks into financial stability assessments, signaling a shift towards more sustainable monetary policies that address the pressing environmental challenges of our time.

Embracing Technological Innovation

The rapid pace of technological innovation presents both opportunities and challenges for monetary policy. Powell has emphasized the necessity of staying ahead of these trends to ensure that the Federal Reserve remains effective in maintaining economic stability and promoting growth in an increasingly digital world.

Conclusion: Reflecting on Jerome Powell's Contributions to Global Finance

Jerome Powell's tenure as the Chair of the Federal Reserve has been characterized by significant achievements and challenges. His leadership has been instrumental in guiding the U.S. and global economies through turbulent times, from implementing innovative monetary policies to addressing global economic challenges. His contributions have left an indelible mark on the world of finance, shaping the future of monetary policy and economic stability.

As you reflect on the key points discussed in this article, consider the broader implications of Powell's policies for the future. We invite you to share your thoughts in the comments section below and explore other articles on our site for further insights into global economics and finance.

References:

- Board of Governors of the Federal Reserve System. (2023). Jerome H. Powell Biography. Retrieved from [Federal Reserve Website]

- U.S. Treasury Department. (2023). Historical Background on Jerome Powell. Retrieved from [Treasury Website]

- International Monetary Fund. (2023). Global Economic Outlook and Policy Implications. Retrieved from [IMF Website]